Homeowners Insurance in and around Madison

Protect what's important from the unexpected.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

Home Is Where Your Heart Is

Your house isn't a home unless you're protected with State Farm's homeowners insurance. This terrific, secure homeowners insurance will help you protect what you value most.

Protect what's important from the unexpected.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Protect Your Home Sweet Home

For insurance that can help cover both your home and your mementos, State Farm has options. Agent James Rodman's team is happy to help you set up a policy today!

Great homeowners insurance is not hard to come by at State Farm. Before the accidental takes place, reach out to agent James Rodman's office to help you figure out what works for your home insurance needs.

Have More Questions About Homeowners Insurance?

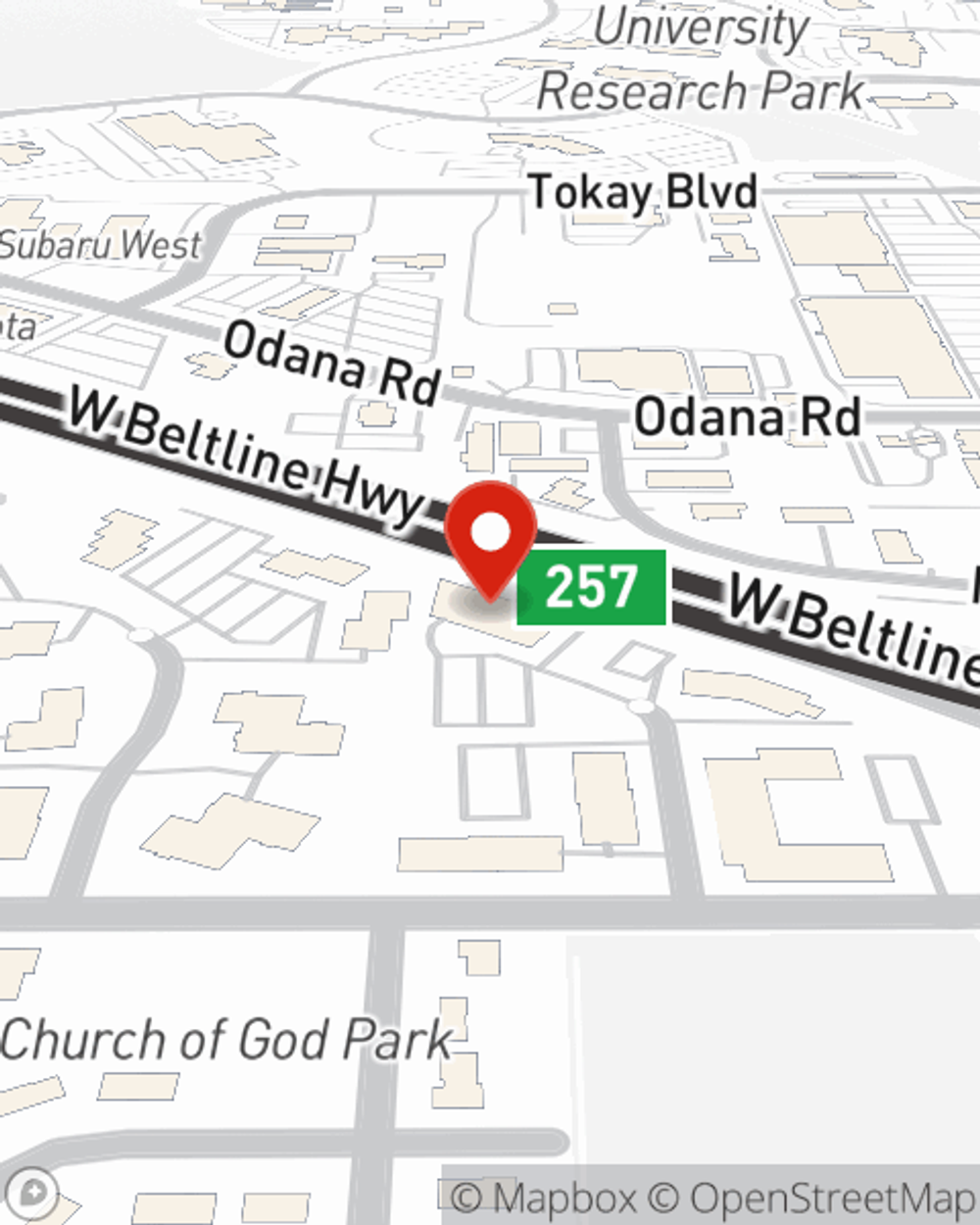

Call James at (608) 274-6500 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

Surprising household hazards

Surprising household hazards

Some household safety risks may surprise you and knowing a few of the culprits is important to help prevent accidents in your home.

James Rodman

State Farm® Insurance AgentSimple Insights®

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

Surprising household hazards

Surprising household hazards

Some household safety risks may surprise you and knowing a few of the culprits is important to help prevent accidents in your home.